Investors Turn Wary Over JPMorgan Redemption Cap

Sebi doesn't have specific norms on limiting investor redemption

Investors in debt funds have reason to worry about some mutual funds carrying excessive credit risks, with JPMorgan Mutual Fund capping redemptions at one per cent of the total outstanding units in two of its short-term debt funds - India Treasury Fund and India Short Term Income Fund.

These schemes, with a collective size of Rs 2,964 crore, recorded a sharp fall in their net asset value (NAV) on Thursday, owing to an ongoing liquidity crisis in Amtek Auto, the financially stressed auto and ancillary company. The two schemes have a sizeable investment (Rs 200 crore) in the debt papers of Amtek Auto, with a coupon of 10.25 per cent.

The Rs 2,534-crore India Treasury Fund had allocated 5.29 per cent (or Rs 134 crore) of assets to Amtek Auto's issuance papers, while the Rs 430-crore India Short Term Income Fund infused a whopping 15.37 per cent (or Rs 66 crore) in the same instrument. For the latter, such large exposure to a single security is more than enough to dramatically impact the performance of the scheme if the underlying asset class faces rough weather.

The Amtek Auto money market paper that the two funds had invested in was rated AA- by CARE Ratings at the end of July this year. However, on August 7, CARE had suspended ratings on the auto ancillary company's debt, as it did not furnish information required to monitor the ratings.

Prabal Banerjee, president (finance and strategy), Bajaj Group, said this would impact the confidence of investors in debt funds and companies would think twice before investing in their funds. "A CFO (chief financial officer) will ask the mutual funds where they are investing their money and there will be increased scrutiny on the investments made by debt funds," he said.

The Securities and Exchange Board of India (Sebi) doesn't have specific norms pertaining to limiting investor redemption. However, most fund houses have a clause in the offer document, stating they can cap redemptions in the interest of the fund house.

On Monday morning, all top distributors got calls from worried investors.

These schemes, with a collective size of Rs 2,964 crore, recorded a sharp fall in their net asset value (NAV) on Thursday, owing to an ongoing liquidity crisis in Amtek Auto, the financially stressed auto and ancillary company. The two schemes have a sizeable investment (Rs 200 crore) in the debt papers of Amtek Auto, with a coupon of 10.25 per cent.

The Rs 2,534-crore India Treasury Fund had allocated 5.29 per cent (or Rs 134 crore) of assets to Amtek Auto's issuance papers, while the Rs 430-crore India Short Term Income Fund infused a whopping 15.37 per cent (or Rs 66 crore) in the same instrument. For the latter, such large exposure to a single security is more than enough to dramatically impact the performance of the scheme if the underlying asset class faces rough weather.

The Amtek Auto money market paper that the two funds had invested in was rated AA- by CARE Ratings at the end of July this year. However, on August 7, CARE had suspended ratings on the auto ancillary company's debt, as it did not furnish information required to monitor the ratings.

Prabal Banerjee, president (finance and strategy), Bajaj Group, said this would impact the confidence of investors in debt funds and companies would think twice before investing in their funds. "A CFO (chief financial officer) will ask the mutual funds where they are investing their money and there will be increased scrutiny on the investments made by debt funds," he said.

The Securities and Exchange Board of India (Sebi) doesn't have specific norms pertaining to limiting investor redemption. However, most fund houses have a clause in the offer document, stating they can cap redemptions in the interest of the fund house.

On Monday morning, all top distributors got calls from worried investors.

He, however, adds the current situation isn't one of panic and should not be compared to the period during the 2008 crisis, when asset management companies such as Mirae Assets and Lotus Mutual Fund had to curtail redemptions for a few days. "Investors should not worry, as only the past few months' gains have been lost. It is not that the entire investment has sunk. The schemes concerned are well diversified and that's why the hit on the NAV (net asset value) is not large, which mutual fund schemes are known about."

The general consensus is this time, it is not an industry-wide problem. Sundeep Sikka, chairman, Association of Mutual Funds in India, said, "The crisis is restricted only to one fund house. We need to be a little more careful, as the sector is gaining in size. I believe the fund house concerned will take all remedial measures to ensure investors do not suffer."

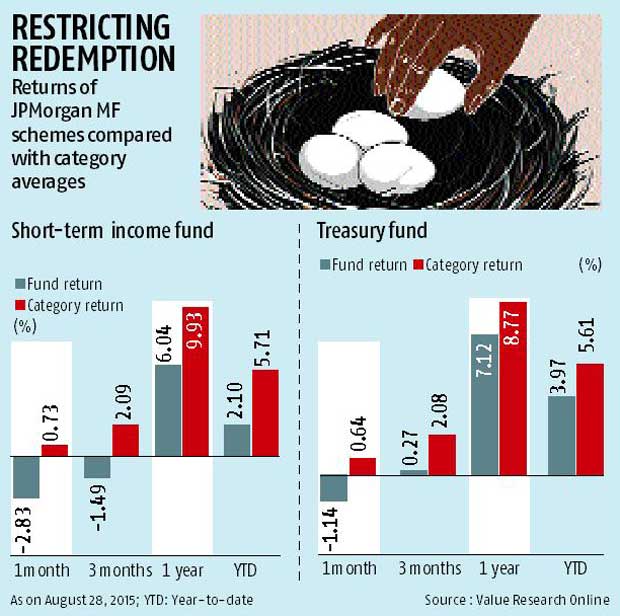

In a matter of just a day (Thursday), JPMorgan's short-term income fund lost all the gains it made so far this financial year, with its NAV falling 3.4 per cent - from Rs 15.83 to Rs 15.29, a level last seen in March this year. The impact on the India Treasury Fund was relatively less, with its NAV declining 1.7 per cent - from Rs 19 to Rs 18.68, a level last seen on June 8 this year.

JPMorgan is a major player in the debt market. Of theRs 4,027 crore of total assets, it has Rs 11,137 crore in debt schemes and only Rs 1,860 crore in equity and Rs 1,024 crore in hybrid schemes.

The fact that JPMorgan Asset Management Company has "gated" redemption hasn't gone down well with its peers in the sector, as well as finance executives. "Putting limitations to redeemable units is not a solution to the problem. This way, the fund house is not letting investors take their own money. Why keep a cap? Let investors take the money at a loss if they wish to," said the chief executive of a large fund house. Another said such moves would only lead to a crisis of confidence. Rather than capping redemptions, the fund house should have taken the hit, he said, adding now, investors would start questioning the net worth of fund houses.

Sebi has already alerted mutual funds on asset quality risks. Recently, it conducted a stress test for liquid funds and wrote to all the 44 asset management companies to check their preparedness to handle redemption pressure. Larger fund houses have been asked to conduct stress tests for funds with more focus on company papers. "There isn't a panic situation or a crisis but the regulator is taking a proactive stance to prevent any crisis," said a source.

Liquid and money market schemes account for about a fourth of the fund sector's overall corpus under management. As of July 31, the total assets under management under this category stood at aboutRs 3 lakh crore. If one includes income funds, too, the overall debt assets would soar toRs 8.5 lakh crore, about 65 per cent of the sector's size ofRs 13.17 lakh crore.

JPMorgan's case is reminiscent of Lotus Mutual Fund's situation in October 2008. Industry players say at that time, there was redemption pressure on the fund, leading to a sharp fall in its assets under management --- fromRs 7,937 crore toRs 5,457 crore. Two institutional schemes - Lotus India Liquid Plus Institutional (Rs 1,430 crore) and Lotus India Liquid Super Institutional (Rs 284 crore) - suffered the most. A fixed maturity plan lost an additional Rs 240 crore. This led to a crisis in the fund house and eventually, it was sold to Religare Aegon in November 2008.

Post a Comment